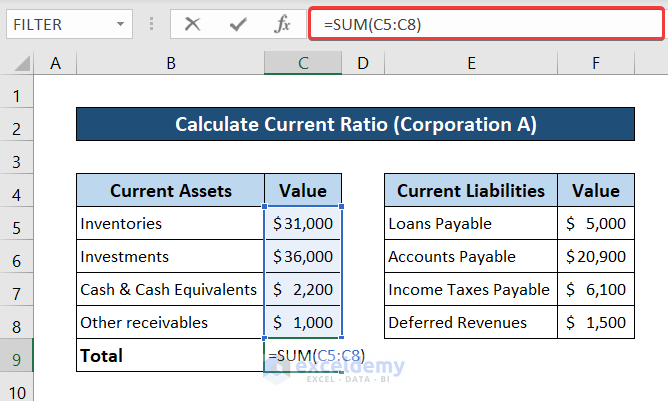

To use the current ratio to make business decisions, you need to understand the balance sheet and the accounts that make up the balance sheet. Business owners must create a list of key metrics used to manage a company, and that list should always include the current ratio. To work with the current ratio, you need to review each of the accounts in the balance sheet and consider how the current ratio can change.

What Is a Good Current Ratio for a Company to Have?

In its Q fiscal results, Apple Inc. reported total current assets of $135.4 billion, slightly higher than its total current assets at the end of the 2021 fiscal year of $134.8 billion. However, the company’s liability composition significantly changed from 2021 to 2022. At the end of 2022, the company reported $154.0 billion of current liabilities, almost $29 billion greater than current liabilities from 2021. A balance sheet is a picture of a company’s financial position at a specific date, and it reports the company’s assets, liabilities, and equity balances. It’s important to review this financial statement to track financial performance. Outside of a company, investors and lenders may consider a company’s current ratio when deciding if they want to work with the company.

Decrease In Current Assets – Common Reasons for a Decrease in a Company’s Current Ratio

For example, suppose a company’s current assets consist of $50,000 in cash plus $100,000 in accounts receivable. Its current liabilities, meanwhile, consist of $100,000 in accounts payable. In this scenario, the company would have a current ratio of 1.5, calculated by dividing its current assets ($150,000) by its current liabilities ($100,000). Other measures of liquidity and solvency that are similar to the current ratio might be more useful, depending on the situation. For instance, while the current ratio takes into account all of a company’s current assets and liabilities, it doesn’t account for customer and supplier credit terms, or operating cash flows. On the other hand, the quick ratio is calculated by subtracting inventory from current assets and dividing the result by current liabilities.

Our Team Will Connect You With a Vetted, Trusted Professional

It aids in evaluating a firm’s financial health and ability to cover immediate debts. One of the simplest ways to improve a company’s current ratio is to increase its current assets. This can be achieved by increasing cash reserves, accelerating accounts receivable collections, or reducing inventory levels. By increasing its current assets, a company can improve its ability to meet short-term obligations. While Company D has a lower current ratio than Company C, it may not necessarily be in worse financial health.

Inventory Management Issues – Common Reasons for a Decrease in a Company’s Current Ratio

The current ratio is a liquidity measurement used to track how well a company may be able to meet its short-term debt obligations. Measurements less than 1.0 indicate a company’s potential inability to use current resources to fund short-term obligations. The current ratio is called current because, unlike some other liquidity ratios, it incorporates all current assets and current liabilities. Current assets that are divided by total current liabilities generate your current ratio, meaning it’s the ratio that determines if your business has sufficient current assets to pay current liabilities. It is important to note that a similar ratio, the quick ratio, also compares a company’s liquid assets to current liabilities.

An analyst or investor seeing these numbers would need to investigate further to see what is causing the negative trend. It could be a sign that the company is taking on too much debt or that its cash balance is being depleted, either of which could be a solvency issue if the trend worsens. Public companies don’t report their current ratio, though all the information needed to calculate the ratio is contained in the company’s financial statements. The inventory turnover ratio is the cost of goods sold divided by average inventory. The average is computed using the same formula as the accounts receivable turnover ratio above. Businesses must also plan for solvency, which is the company’s ability to generate future cash inflows.

- Lenders and creditors also use the current ratio to assess a company’s creditworthiness.

- Instead, we should closely observe this ratio over some time – whether the ratio is showing a steady increase or a decrease.

- It helps investors, creditors, and other stakeholders evaluate a company’s ability to meet its short-term financial obligations.

- To use the current ratio to make business decisions, you need to understand the balance sheet and the accounts that make up the balance sheet.

- Ultimately, the current ratio helps investors understand a company’s ability to cover its short-term debts with its current assets.

A company may have a good current ratio compared to other companies in its industry, even if it is below the general benchmark of 1. Ignoring industry benchmarks can lead to incorrect conclusions about a company’s financial health. Negotiating better supplier payment terms can also improve a company’s current ratio. By extending payment terms or negotiating discounts for early payment, a company can improve its cash flow and increase its ability to meet short-term obligations.

The current ratio can be a useful measure of a company’s short-term solvency when it is placed in the context of what has been historically normal for the company and its peer group. It also offers more insight when calculated repeatedly over several periods. For example, a normal cycle for the company’s collections and payment processes may lead to a high current ratio as payments are received, but a low current ratio as those collections ebb. A current ratio that is in line with the industry average or slightly higher is generally considered acceptable.

Negative working capital, on the other hand, means that the business doesn’t have enough liquid assets to meet it current or short-term obligations. This is often caused by inefficient asset management and poor cash flow. If the business does not have enough cash to pay the bills as they become due, it will have to borrow more money, which will in turn increase its short-term obligations. abusive tax shelters and transactions Since the working capital ratio measures current assets as a percentage of current liabilities, it would only make sense that a higher ratio is more favorable. This means that the firm would have to sell all of its current assets in order to pay off its current liabilities. If a company’s current ratio is too high, it may indicate it is not using its assets efficiently.

Another practical measure of a company’s liquidity is the quick ratio, otherwise known as the “acid-test” ratio. For the last step, we’ll divide the current assets by the current liabilities. A lower quick ratio could mean that you’re having liquidity problems, but it could just as easily mean that you’re good at collecting accounts receivable quickly.